Health insurance can feel overwhelming for beginners, but understanding the basics can help you make better financial and healthcare choices. With so many terms, policies, and coverage options to consider, it’s essential to learn what health insurance is and how it works. This guide breaks down the essentials, helping you choose the best plan for you and your family.

What is Health Insurance?

At its core, health insurance is a contract between you and an insurance provider. You pay a monthly premium, and in return, the insurance company helps cover the cost of medical expenses. Health insurance protects you from high medical costs, making it easier to access healthcare without financial strain.

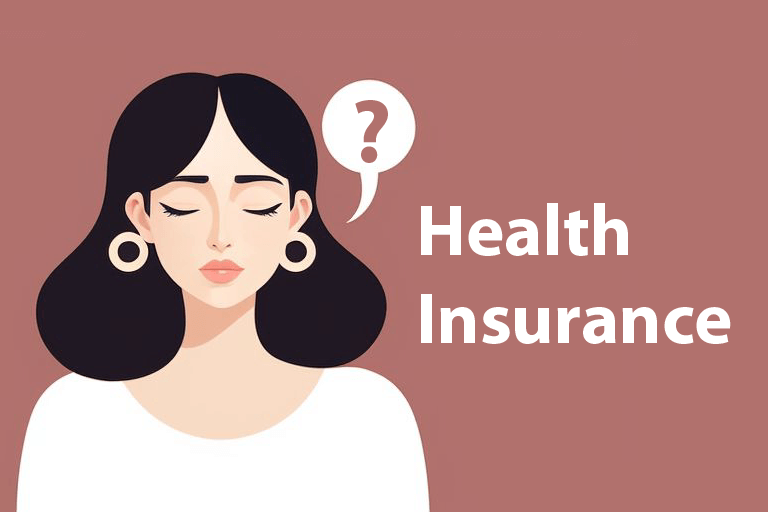

Types of Health Insurance Plans

There are several common types of health insurance plans, each with its own features and flexibility. Understanding these will help you choose the one that best fits your needs: Car Insurance

- HMO (Health Maintenance Organization): Provides coverage within a specific network of doctors and hospitals. You typically need referrals to see specialists.

- PPO (Preferred Provider Organization): Offers more flexibility, allowing you to visit any doctor or specialist, though you’ll save more by using in-network providers.

- EPO (Exclusive Provider Organization): Similar to PPO but only covers services within the network, except for emergencies.

- POS (Point of Service): Combines HMO and PPO features, requiring referrals but offering the option to go out-of-network at a higher cost.

Why this matters: Knowing the type of plan that fits your lifestyle and budget is essential to avoid unexpected costs.

Understanding Health Insurance Costs

Health insurance comes with several different costs, beyond just the monthly premium. Here’s a quick breakdown:

- Premium: The monthly payment you make to keep the insurance active.

- Deductible: The amount you pay out-of-pocket before your insurance starts covering costs.

- Co-payments and Co-insurance: A fixed amount (co-pay) or percentage (co-insurance) you pay for services after meeting your deductible.

- Out-of-Pocket Maximum: The most you’ll pay in a year for covered services, after which the insurance covers 100% of costs.

Tip: Always check these costs before selecting a plan to avoid any financial surprises.

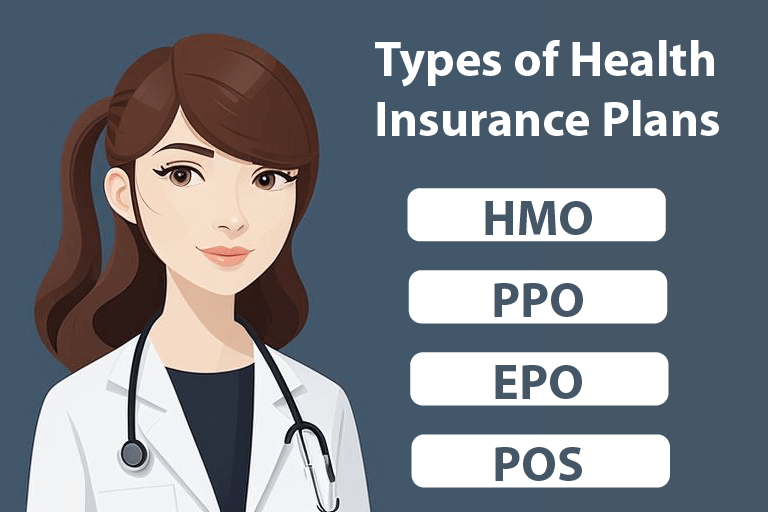

In-Network vs. Out-of-Network Providers

Most insurance plans have a network of healthcare providers. In-network providers have agreements with your insurance company to offer services at reduced rates, while out-of-network providers usually cost more. Choosing in-network providers helps reduce your medical bills, so it’s important to check if your preferred doctors and hospitals are covered by your plan.

Why this matters: Staying in-network keeps your medical costs lower, making it easier to manage your healthcare expenses.

Preventive Care and Coverage Benefits

Many health insurance plans cover preventive care at no extra cost. This includes routine check-ups, screenings, vaccinations, and certain wellness services. Preventive care helps catch potential health issues early, saving you money and improving your overall health.

Common preventive services covered:

- Annual physical exams

- Immunizations (e.g., flu shots)

- Screenings (e.g., cholesterol, blood pressure)

Tip: Take advantage of these free services to maintain your health and avoid more costly treatments later

How to Choose the Right Health Insurance Plan

Choosing the best health insurance plan depends on your specific needs, budget, and lifestyle. Here’s a step-by-step approach:

- Evaluate Your Needs: Consider your age, health status, and whether you have regular prescriptions or medical needs.

- Calculate Costs: Look beyond the premium to assess total potential costs, including deductible, co-pays, and out-of-pocket maximum.

- Check the Network: Ensure your preferred healthcare providers and local hospitals are within the plan’s network.

- Consider Extra Benefits: Some plans offer additional perks like telemedicine, mental health services, or wellness programs.

Reminder: The right plan balances coverage and affordability. Don’t choose based solely on premium costs; consider the total financial picture.

Conclusion

Understanding health insurance doesn’t have to be intimidating. By learning the basics, comparing plans, and carefully assessing your needs, you can select a health insurance plan that provides the right coverage at a price you can afford. Health insurance is an essential tool for managing healthcare expenses and protecting yourself from unexpected medical costs, so take your time, ask questions, and choose wisely. blogs.

“Ready to take the first step? Start your fitness journey today by committing to one of these habits, and be sure to check out our upcoming blog posts for more tips and personalized workout plans!”